In early 2019, TransUnion reallocated budget across all platforms and challenged Wpromote to increase efficiency with the remaining investment. The standard course of action would be to cut non-branded campaigns and focus solely on brand, which would probably result in short-term success. Wpromote knew that to hit TransUnion’s 2020 goals, they would need to think longer term. Instead of cutting non-brand investment for short-term benefit, Wpromote noted that impression share for brand campaigns was at 93%, which meant there wasn’t room for significant growth on the brand side. The team strategized with TransUnion to instead reduce brand budget and focus on scaling non-branded campaigns.

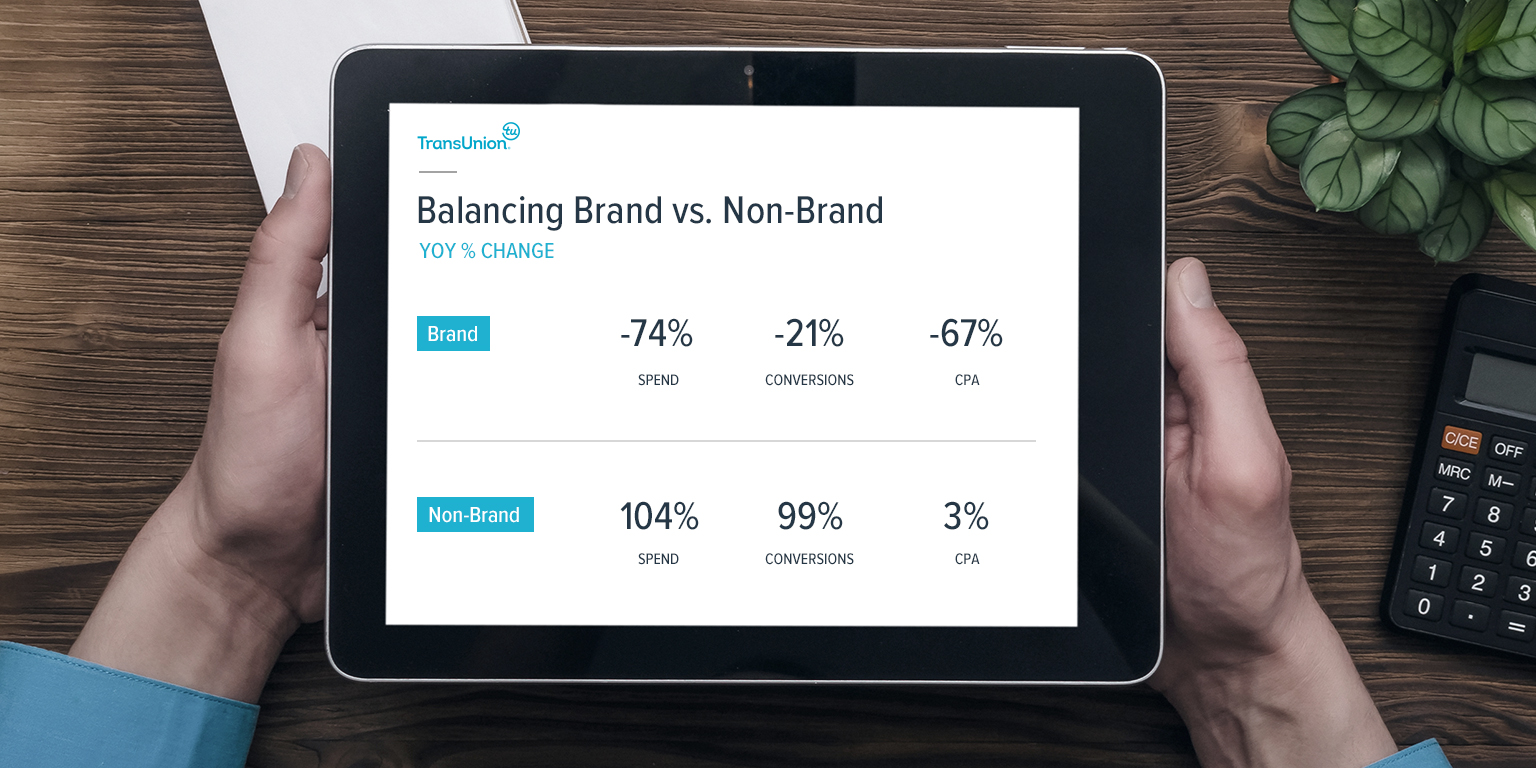

The primary challenge facing the team was how to scale back on the brand investment without seeing a significant decline in orders as brand accounted for 76% of paid search conversions in 2018. After analyzing the data, the team recommended pausing one of their smaller domains competing in the same auctions, pausing low-performing keyword campaigns, and reducing bids significantly to pressure the competition. We succeeded in spending 80% less on brand keywords, while conversions only declined 27% and CPA reduced 73% (Dec 2018 and Jan 2019 to February 2019 and March 2019).

With brand CPA down, there was more leeway to invest in non-branded paid search campaigns. Wpromote recommended an increase in non-brand investment once TransUnion had additional budget, since that was the area with the highest potential for growth. Although we were using automated bidding through 247.ai, we were eager to test alternative bidding platforms that could help us scale even further. Wpromote started vetting out other bidding platforms with a focus on scaling while maintaining efficiency, two goals that are a constant balancing act for TransUnion. The team identified auction-level bidding, a soon-to-be beta through SA360, as the likely solution to the scaling challenge. As soon as the beta was available, the team jumped at the chance to start testing.

The team decided to A/B test four non-brand campaigns, two with high volume and two with low conversion volume. After the first month, SA360 generated 17% more orders with a 13% stronger efficiency compared to 247.ai bidding. What the team found most interesting is that a lower volume campaign, that historically only generated a handful of conversions per month on 247.ai automated bidding, generated 440% more conversions on SA360 with a 12% more efficient CPA. The auction-level bidding was identifying high-intent search queries that keyword-level bidding was not capturing. Due to the success of the automated bidding test, all campaigns were moved over to SA360 bidding to utilize the auction-level bidding beta for the remainder of the year.